SFR Growth & Income Fund I, LLC

506(c) Offering Platform

INTRODUCTION

SFR Growth & Income Fund I, LLC (the “Company” or the “Fund”) is a private real estate fund formed for the purpose of acquiring and managing single family residential real estate assets and to purchase partnership interests in Miramar MCB DFW SFR I, a Delaware limited partnership (the “LP”). The Fund is managed by MCB Capital, LLC (“MCB” or the “Manager”), a Texas company formed in 2020 that specializes in real estate asset acquisition and management. MCB is led by two highly experienced real estate and finance professionals Michael Cook and Benjamin Lyng. These two principals have a combined 22 years of experience successfully managing residential real estate investments.

The Manager’s leadership team has purchased, leased, financed and managed more than 4,000 single family residential (“SFR”) rental units, including more than 1,000 homes in the Fund’s target market of Dallas – Ft. Worth, Texas.

The Manager brings specialized skills unique to the SFR asset class. Its diligence, acquisition, lease-up, and management principles specific to the SFR asset class, along with its access to national lending platforms, are designed to give the Fund a significant competitive advantage.

The Fund’s primary managers are directly involved in the placement of investment funds into select real estate assets. By investing in a Fund with experienced and specialized management, investors are freed from the complexities and time required for individual property ownership.

The Fund’s management started in the SFR space during the previous financial crisis. This experience of managing through volatility, a downturn and subsequent recovery, gives MCB the ability to mitigate risk, avoid problems, and capitalize on opportunities that less experienced managers may encounter or miss. This experience also better positions the Fund to take advantage of market opportunities presented in times of uncertainty, such as the COVID-19 pandemic.

Accredited investors may request the Fund’s private placement memorandum, which will outline the Fund’s proprietary strategies for executing on these opportunities and the pertinent details regarding investment in the Fund’s securities.

SFR Growth & Income Fund I, LLC

506(c) Offering Platform

summary of operations

The Fund intends to operate as a real estate investment fund with substantially all allocated capital being utilized for investments that will mature over a two to five year period. The Fund’s execution strategy for those opportunities is detailed below:

Property Acquisition Phase

MCB will be using operational principles and best practices that enabled Mr. Cook to led a team at a previous fund that purchased more than 100 single family residential investment properties per month during its property acquisition phase.

Many of the Fund’s opportunities will be value-add acquisitions sourced through the Manager’s professional and institutional real estate network in DFW. The management team’s specialized approach to buying single family properties, developed over nearly ten years of focus on this asset class, seeks to acquire properties where equity and value is present at the time of acquisition, and is enhanced through the re-positioning, marketing, and management processes.

The Manager anticipates that properties acquired during this phase will require $1,000 - $50,000 in improvements designed to strategically position it for use as a single family residential rental unit and enhance the property’s value.

The construction, budgeting, and upgrade experience of the Manager’s leadership, with a focus on the unique requirements of single family residential houses as rental units, is a critical part of this process. This will allow the Fund to fully assess expected costs, time-frames, and other important metrics to maximize profit and minimize risks related to unexpected upgrade costs and re-positioning expenses.

Stabilized phase (1 to 5 years)

The Manager intends to hold and manage properties for a period of one to five years, and opportunistically sell as a portfolio to an institutional investor, as individual sales to retail home buyers, or a combination of these two exit strategies.

Acquisition Criteria

- Property Type: single family residential properties

- Large percentage of portfolio consisting of 3 bedroom / 2 bathroom floor plans or larger

- Access to quality neighborhood schools

- Estimated Average Age of Target Properties: 0 - 50 years old

- Opportunity to optimize properties for use as SFR rentals through standardized upgrades and modifications

- Within a 35 min drive to and within the DFW area

- Ideal locations situated near public transportation, shopping, and employment centers

- Acquisition price plus any necessary renovations less than 95% of fair market value

- Upside rent and valuation potential from asset enhancements and re-positioning

SFR Growth & Income Fund I, LLC

506(c) Offering Platform

Company Management Team

MCB Capital, LLC

Manager Entity

MCB Capital, LLC (“MCB” or the “Manager”) was formed in 2020 in the state of Texas. The managers of MCB Capital, LLC are Michael Cook and Benjamin Lyng.

Michael Cook

Co-Founder / Chief Investment Officer

Michael Cook is a former Chief Assets Officer at Sylvan Road and a Director of U.S. Asset Management at GTIS. During his time at Sylvan Road, he managed over 2,000 single family homes and acquired over 120 homes per month in seven different markets. While at GTIS, Mr. Cook built a single-family platform to purchase, manage and sell over 4,000 single family homes.

Mr. Cook’s experience in the real estate industry began in 2005. Prior to joining GTIS Partners, Mr. Cook worked for Wells Fargo’s Real Estate Special Situations Group, where he handled numerous distressed-debt restructures and foreclosures across all property types, all geographies and all levels of the capital stack, ranging in size from $2MM to $900MM+. Prior to Wells Fargo, Mr. Cook was an Associate in Wachovia’s Real Estate Investment Banking Group.

Mr. Cook received an M.B.A. with a concentration in Real Estate Finance from Cornell University’s Johnson School of Management and a B.S. in Applied Economics and Management from Cornell University’s College of Agriculture and Life Sciences.

Benjamin Lyng, CFA

Co-Founder / Chief Financial Officer

Benjamin Lyng is a real estate investor with a successful ten year track record of investing in residential real estate. He is also a former banker at Deutsche Bank, J.P. Morgan, and Wells Fargo. While at Deutsche Bank, he served on deal teams that closed more than $1 billion in investment banking transactions. At J.P. Morgan and Wells Fargo, he led private banking teams that covered some of his banks’ most strategic clients.

Before working in finance and real estate, Mr. Lyng was an explosive ordnance disposal (EOD) officer in the US Army. He completed three overseas deployments to the Middle East, culminating in an assignment as an EOD company commander, where his unit was responsible for destroying roadside bombs and weapons caches in combat. Mr. Lyng was awarded the Bronze Star Medal in Kandahar, Afghanistan.

Mr. Lyng received an M.B.A. with a concentration in Investment Banking from Cornell University’s Johnson School of Management and a B.S. in Accounting from American University’s Kogod College of Business. He also holds the Chartered Financial Analyst designation.

Jenelle Berry Cook

Co-Founder / Chief Revenue Officer

Jenelle Berry-Cook is a licensed Realtor® in Texas. As a real estate professional with extensive experience in business development and customer experience strategy, and an M.B.A. from Columbia Business School, Jenelle is passionate about finding solutions that bring real value to her clients and help advance them towards achieving their real estate investment goals.

Early in her career, Mrs. Berry-Cook developed her skills in client management as a pharmaceutical sales consultant at Pfizer. After earning her M.B.A., she spent nearly a decade launching and leading global marketing initiatives for major international organizations including L’Oreal and Estee Lauder. Prior to transitioning into real estate, Jenelle developed and led large-scale strategic initiatives including new store openings, retail restructurings, and only-at-Apple consumer programming across Apple, Inc.’s global retail footprint.

Mrs. Berry-Cook received an M.B.A with a concentration in Marketing Strategy from Columbia University and a B.A. in International Relations from Tufts University.

SFR Growth & Income Fund I, LLC

506(c) Offering Platform

terms of the offering

$20,000,000

Minimum Offering: $500,000

Minimum Investment: $100,000 (100 Units)

The Company is offering a minimum of 500 and a maximum of 20,000 Class A Membership Units at a price of $1,000 per Unit. Upon completion of the Offering between 1,000 and 20,000 Class A Membership Units will be issued.

Distributions of Net Operating Cash Flow: Distributions of Net Operating Cash Flow, if any, shall be distributed at the discretion of the Manager quarterly within forty-five (45) days after the end of each calendar quarter. All distributions of Net Operating Cash Flow shall be distributed as follows:

- (i) first, to the Class A Members, as a group, pro rata until each Class A Member has received such Member’s respective Class A Preferred Return; then to the Class A Members until the Class A Members have received aggregate distributions and payments of an amount equal to their original capital contributions

- (ii) then, after allowance for any reserves or other uses of funds in the sole discretion of the Manager, eighty percent (80%) to the Class A Interests issued and outstanding, pro rata and the balance to the the Manager or affiliate.

Distributions of all or any portion of Net Capital Event Proceeds shall be made within forty-five (45) days after the end of a Fiscal Year. All distributions of Net Capital Event Proceeds shall be distributed as follows:

- (i) first, to the Class A Members, as a group, pro rata based upon each such Member’s respective unpaid Class A Preferred Return, until such Class A Members have been paid their respective Class A Preferred Return; then

- (ii) to the Members to the extent and in proportion with their Invested Capital Contributions until the aggregate amount distributed to such Members pursuant to Sections 10.1 and 10.2 of the Operating Agreement is sufficient to provide for a return of such Members’ Capital Contributions by the Company;

- (iii), then, after allowance for any reserves or other uses of funds as determined by the Manager in its sole discretion, eighty percent (80%) to the Class A Members, pro rata based upon Percentage Interest and the twenty percent (20%) balance to the Manager or affiliate.

CONTACT US

Please complete the contact form and we will get back to you about any questions you have about our offering.

SFR Growth & Income Fund I, LLC - 120 Campbell Rd Ste 103 - Dallas, TX 75248 — ben@mcbcap.com — (719) 660-0679

SFR Growth & Income Fund I, LLC

506(c) Offering Platform

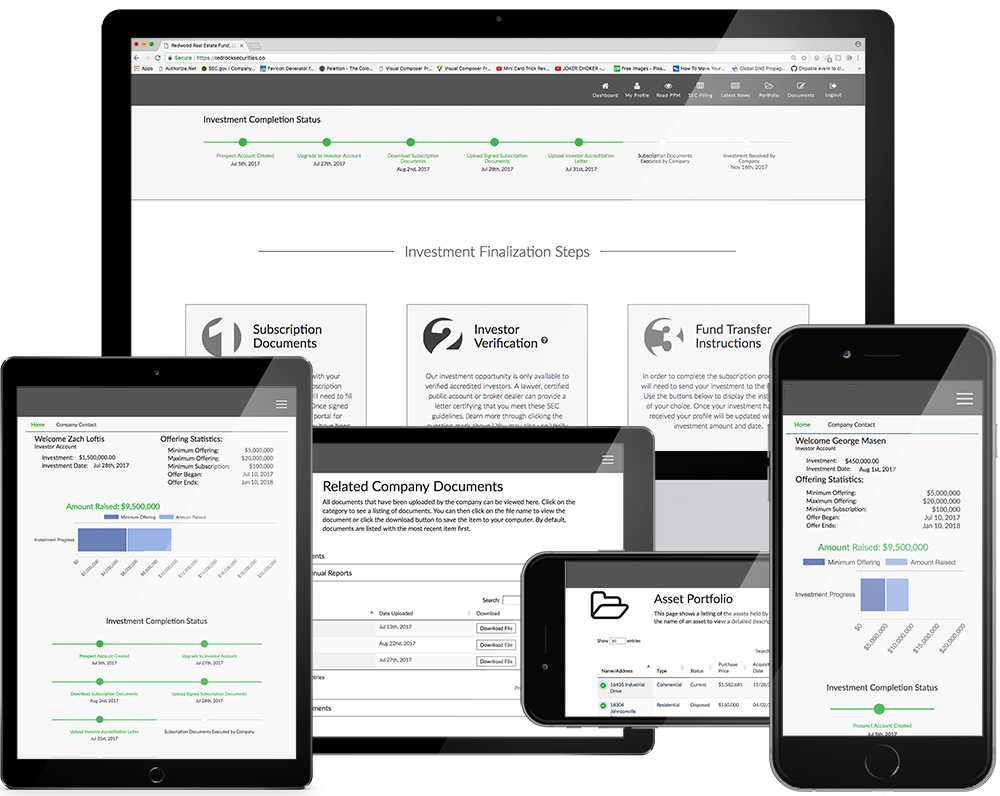

so much more than what you see

The SFR Growth & Income Fund I, LLC 506(c) Investor Portal provides the opportunity to learn about our investment opportunity. Once registered, you will be able to

- Access the Private Placement Memorandum, which outlines our company and gives greater detail about our offering;

- Access our SEC filing;

- View real time offering metrics of how far along we are in the offering process;

- View a timeline of your progress in the subscription process;

- View company contact information; directly contact the administrator;

- Easily upgrade your account with the click of a button.

Once your account is upgraded you will have additional access including the ability to:

- Complete the subscription documents;

- Upload subscription and accreditation documents as applicable;

- View specific information for investing and instructions on transfer of investment funds;

- Review company documents including Reports, Financials, and Supporting Documents;

- Access the asset portfolio as applicable;

- Access news articles written by the company;

- View documents associated with your account.